Among the many premium cards available in India, the SBI Aurum Credit Card stands out. Launched as SBI Card’s flagship lifestyle card, it targets high-income professionals and individuals who seek more than just reward points. With an annual fee of ₹9,999 plus GST, unlimited international lounge access, milestone Apple and TataCliq vouchers, and complimentary BookMyShow tickets, the Aurum is clearly not meant for everyday spenders. Instead, it appeals to a limited audience: those with annual incomes of ₹40 lakh and above or long-standing premium relationships with SBI.

Most people look for this card to see if its high fee is justified by its benefits. Unlike cashback cards or popular co-brands, Aurum focuses on status, exclusivity, and luxury perks. That means the real question isn’t just about what it offers, but whether it suits your lifestyle and spending habits.

SBI Aurum Credit Card Benefits

The SBI Aurum Credit Card benefits cater to premium users who travel frequently, dine at upscale places, and prefer lifestyle experiences over cashback. Unlike regular credit cards, Aurum is in the super-premium category, and its benefits reflect this.

First, the joining fee of ₹9,999 plus GST is offset by 40,000 reward points, which is worth ₹10,000. This helps serious users recover the upfront cost right from the start. The card’s benefits fall into four main categories: travel, lifestyle, entertainment, and milestone rewards.

In travel, Aurum offers unlimited international lounge access and 16 complimentary domestic lounge visits each year. Frequent flyers will appreciate the reduced 1.99% forex markup, which is much lower than the common rate of 3.5%. This makes it a smart choice for spending abroad.

Regarding lifestyle, Aurum cardholders get concierge services, golf benefits, and premium memberships to services like the Wall Street Journal and Mint. These privileges focus on enhancing experiences that fit a luxury lifestyle rather than providing everyday discounts.

The entertainment benefits are also impressive, with four free BookMyShow tickets each month, capped at ₹250 each. This totals up to ₹1,000 per month or ₹12,000 annually if fully used, which already exceeds the annual fee.

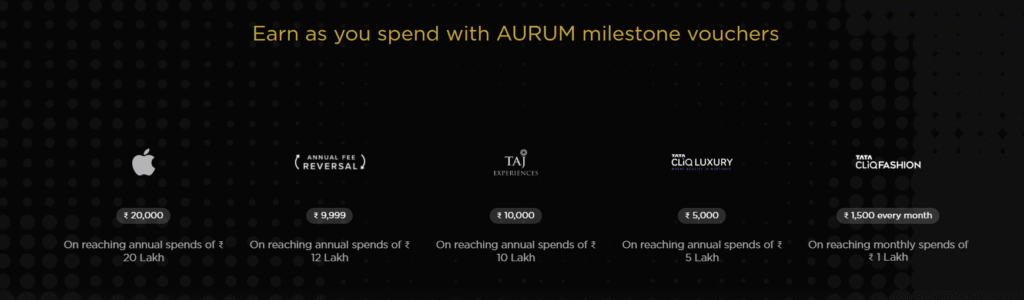

Lastly, the SBI Aurum Credit Card benefits include milestone rewards. Spending ₹1 lakh monthly earns TataCliq vouchers worth ₹1,500, while annual milestones can yield Apple vouchers worth up to ₹20,000 for spending over ₹20 lakh. For high-spending professionals, these rewards add significant real value to the card.

What sets Aurum’s benefits apart is its focus on serious users. A customer who spends heavily on travel and luxury services will gain much more value than the annual fee, while those with limited use for lounges, milestone vouchers, or concierge services may find the card costly.

SBI Aurum Credit Card Reward Points

The SBI Aurum Credit Card reward points aim to support its premium image. Unlike standard cards that offer high reward rates, the Aurum card balances points with milestone benefits and lifestyle perks.

With regular spending, cardholders earn 4 Aurum Points for every ₹100 spent. This gives an effective rate of 1%. While this may seem low compared to some cashback cards, real value comes from redemption options and additional vouchers linked to spending milestones. Each reward point is worth ₹0.25 and can be redeemed for:

- Travel bookings through SBI Card’s partner portal

- Lifestyle vouchers from Apple, TataCliq, and other premium brands

- Direct statement credit, making it easy to redeem for daily expenses

Milestone Benefits

A significant advantage of the SBI Aurum Credit Card reward points is their combination with milestone rewards. For instance, spending ₹1 lakh monthly generates 4,000 Aurum Points (worth ₹1,000) and unlocks a TataCliq voucher worth ₹1,500, effectively increasing the return rate. Similarly, annual spending of ₹20 lakh yields 80,000 Aurum Points (valued at ₹20,000) plus an additional ₹20,000 Apple voucher, doubling the benefits.

When considering larger purchases, the base 1% reward rate rises to about 3.5% to 3.7% return if the user consistently meets milestone goals. This makes the rewards meaningful for high-spending professionals, especially those who fit into Aurum’s luxury ecosystem.

However, it’s important to remember that for users who do not reach milestones, the SBI Aurum Credit Card reward points alone may not justify the high annual fee. The system is designed for volume spenders who can maximize both base rewards and milestone bonuses.

SBI Aurum Credit Card Fees

The fees for the SBI Aurum Credit Card are high, reflecting its premium status. The card charges a joining fee of ₹9,999 plus GST. The annual renewal fee is the same amount. You can get a fee waiver if you spend ₹12 lakh in a year. However, unlike regular cards, not everyone can easily reach this spending level. This card is best for high-spending professionals who can either earn milestone vouchers and benefits or consistently meet the spending requirement for the waiver.

AURUM Has Got You Covered: Insurance Benefits

The SBI Aurum Credit Card offers more than just luxury benefits. It provides strong insurance coverage, which keeps cardholders financially safe while they enjoy a premium lifestyle. Whether it’s air travel accidents, lost baggage, or fraudulent transactions, Aurum protects your spending and your peace of mind.

SBI Aurum Credit Card Eligibility

SBI Aurum Credit Card Review

The SBI Aurum Credit Card is not a regular card. It is a high-end, premium credit card aimed at wealthy individuals. With an annual fee of ₹10,000 plus GST, it may seem pricey at first. However, this cost is largely offset by the welcome reward points given upon joining. These points can nearly cover the fee, making the card rewarding for eligible users right away.

One of the card’s most attractive features is its milestone rewards program. By reaching spend milestones, cardholders can earn Apple and TataCliq vouchers, as well as complimentary lifestyle benefits. When you add these to the standard reward points from each transaction, the potential net return ranges from 3 to 7%. This is especially appealing for frequent travelers, luxury shoppers, and high-income professionals who can make the most of Aurum’s premium benefits.

It’s worth noting that SBI Aurum is an invite-only card. Regular users cannot apply directly. Eligibility typically requires an annual income over ₹40 lakh. For those who meet the requirements and spend wisely, the card not only offers rewards but also significant savings on lifestyle and travel expenses. Additionally, it includes exclusive perks like unlimited airport lounge access, concierge services, and premium subscriptions.

In summary, considering its reward structure, milestone benefits, and luxury perks, the SBI Aurum Credit Card stands out for privileged, high-spending individuals. While it is not suitable for casual users, it provides great value, convenience, and status for those who qualify.

FAQ

What is the SBI Aurum Credit Card?

The SBI Aurum Credit Card is a premium card available by invitation only. It is designed for high-net-worth individuals and offers luxury benefits, milestone rewards, and travel perks.

What are the SBI Aurum Credit Card benefits?

Key benefits include unlimited international lounge access, milestone vouchers for Apple and TataCliq, concierge services, premium subscriptions, and extensive insurance coverage.

What is the eligibility for the SBI Aurum Credit Card?

Applicants typically need an annual income above ₹40 lakh, a credit score of 750 or higher, and often an invite from SBI to apply.

What is the SBI Aurum Credit Card limit?

The limit varies for each individual and often reaches several lakhs or more. It depends on income and credit profile since it is a super-premium card.

Is the SBI Aurum Credit Card available for IIM students?

Yes, in select cases. Current students of IIM A, B, and C may access Aurum through SBI campus branches, sometimes with Lifetime Free offers. Alumni do not have a direct option.

What are the SBI Aurum Credit Card fees?

The annual fee is ₹10,000 plus GST. However, this fee is offset by welcome points and milestone rewards, which lowers the effective cost.

How do I log in to SBI Aurum Credit Card services?

You can log in through the SBI Card website or the SBI Card mobile app using your registered credentials.

What is the SBI Aurum Credit Card customer care number?

For assistance, you can call the dedicated Aurum helpline 1800-180-1290 or the general SBI Card helpline 1860-180-1290.

How can alumni apply for the SBI Aurum Credit Card?

There is no separate alumni route. Alumni must meet the standard invite-only eligibility criteria to access the card.

How to get the SBI Aurum Credit Card?

You can express interest on the official Aurum website, but approval depends on eligibility and SBI’s invitation process.

Is SBI Aurum Credit Card good?

Yes, if you have a high income and make premium lifestyle purchases. With milestone rewards and perks, effective returns can reach 3 to 7 percent, making it excellent for top-tier users.

Related Articles

IndusInd Pinnacle Credit Card Review 2025 – Benefits, Fees & Reward Redemption

SBI Flipkart Credit Card Review 2025 Cashback, Fees & Benefits!

KrisFlyer 2025 Updates: Access Redemption, Scoot Award Flights & Miles Earning

Axis Flipkart Credit Card vs SBI Flipkart Credit Card

SBI Flipkart Credit Card Review 2025 Cashback, Fees & Benefits!

IDFC FIRST Millennia Credit Card Review – Lifetime Free

What Changed in Axis Bank Dining Delights starting 1 August 2025?