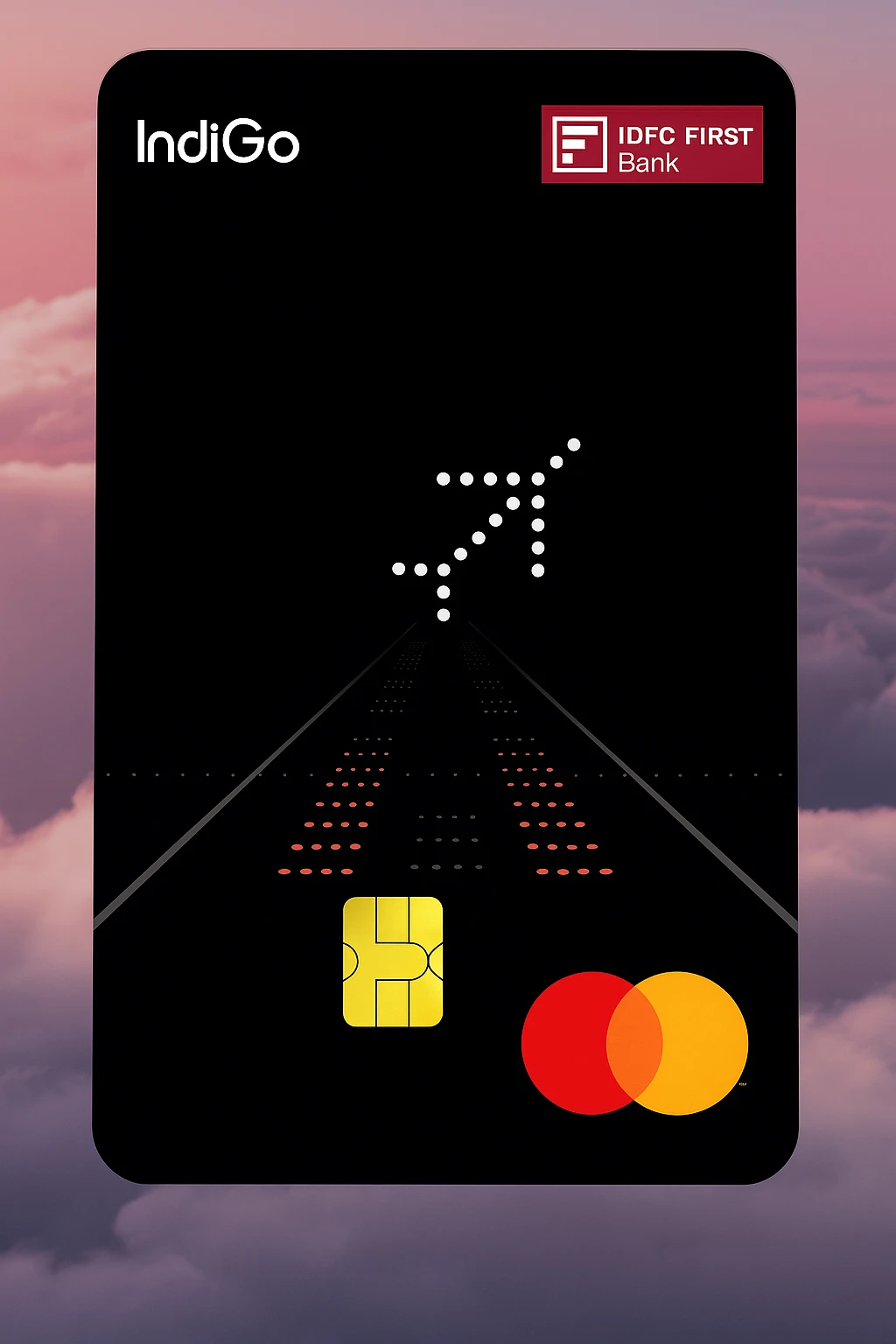

The IndiGo IDFC FIRST Dual Credit Card is a significant step for IndiGo, as it establishes a stronger presence in the co-branded credit card market. It targets frequent flyers and IndiGo fans. This card is unique because it offers two options, Mastercard and RuPay, issued together as one product with a shared credit limit and reward pool. The Mastercard version provides global benefits, while the RuPay card works well with UPI payments, making it a practical choice for both domestic and international use. The card is mainly for users who often fly with IndiGo and want to maximize their flight booking rewards through BluChips, IndiGo’s rewards platform. Applicants can choose to get the card by paying a ₹4,999 joining fee (plus GST) or by putting down a ₹1 lakh fixed deposit. However, welcome benefits are only available with the paid option. With a focus on travel, UPI flexibility, and different rewards, the card aims to serve a specific but growing group of airline-focused credit card users.

What is a Dual credit Card?

A dual credit card is a type of credit card that provides the customer with two separate physical cards. One card operates on the Mastercard network and the other on the RuPay network. Both cards are linked to a single credit limit and account. Although the customer has two cards, there is only one credit line, one statement, and one payment due per billing cycle. The Mastercard card is ideal for international transactions and premium merchants, while the RuPay card enables UPI-based transactions, including mobile payments and QR-code scanning. This setup offers more flexibility by combining the global reach of Mastercard with the UPI compatibility and convenience of RuPay. It is especially helpful for users who want to maximize acceptance and rewards on both platforms without managing multiple accounts.

Welcome Benefits

Customers who choose the paid version of the IndiGo IDFC FIRST Dual Credit Card by paying the ₹4,999 joining fee (plus GST) receive a selection of travel and lifestyle welcome perks. The main benefit is a 5,000 BluChips voucher, credited soon after card activation, which can be used to book IndiGo flights. Cardholders also receive a complimentary IndiGo meal voucher, which improves the overall flight experience.

As part of its lifestyle incentives, the card gives a 3-month EazyDiner Prime membership. This membership offers discounts and deals at top restaurants and includes a ₹3,000 hotel stay voucher from The Postcard Hotels, appealing to luxury travelers.

It’s important to understand that these welcome benefits do not come with the FD-backed version of the card. While the fixed deposit option waives the first-year fee, it lacks any joining perks, making the paid option more appealing for users seeking immediate value.

Top Features of IndiGo IDFC FIRST Dual Credit Card

- Dual Card Setup: This card includes both Mastercard and RuPay options. They are linked to one credit limit and offer combined rewards.

- UPI Compatibility: You can add the RuPay card to UPI apps. This allows for QR payments using a credit card for daily purchases.

- IndiGo BluChips Rewards: You earn BluChips on IndiGo flight bookings as well as regular spending. You earn more BluChips when you book through the airline’s app or website.

- Flexible Application: You can either pay a ₹4,999 joining fee or get the card for free for the first year with a ₹1 lakh fixed deposit.

- Forex Mark-up: The forex markup is reduced to 1.49%. This is helpful for international transactions.

- Shared Billing & Statements: Both cards are billed together, and you receive a single monthly statement. This makes tracking and repayment easier.

Milestone Benefits

As published on the official IDFC Bank website, this Card rewards regular spending with a milestone benefit program designed for frequent flyers. Cardholders can earn up to 25,000 BluChips every year by reaching certain spending goals. These are given as five separate vouchers of 5,000 BluChips each when the cardholder spends ₹2 lakh, ₹5 lakh, ₹8 lakh, ₹10 lakh, and ₹12 lakh within a membership year. The milestone vouchers go directly into the IndiGo BluChips account and can be used for flight bookings on the IndiGo website or app.

Fees & Charges

| Charge Type | Amount / Condition |

|---|---|

| Joining Fee | ₹4,999 + GST (waived if applied through FD of ₹1 lakh) |

| Annual Fee (2nd year onwards) | ₹4,999 + GST (applicable on both variants, including FD-backed) |

| Add-on Card Fee | Currently not listed separately (assumed same as primary unless stated otherwise) |

| Finance Charges (Interest Rate) | 0.71% to 3.85% per month (8.5% to 46.2% p.a. based on credit profile) |

| Cash Advance Fee | ₹199 per transaction |

| Late Payment Charges | 15% of total amount due (min ₹100, max ₹1,300) |

| Overlimit Charges | 2.5% of overlimit amount (min ₹550) |

| Card Replacement Fee | ₹199 per card |

| Reward Redemption Fee | ₹99 per redemption transaction |

| Forex Mark-up Fee | 1.49% on international transactions |

| Fuel Surcharge Waiver | 1% waiver on fuel transactions between ₹200 – ₹5,000 per transaction |

| Rent Payment Fee | 1% of transaction amount (min ₹249 per transaction) |

| Utility Fee (if > ₹20K/month) | 1% of total utility spends if monthly aggregate exceeds ₹20,000 |

| Education Payment Fee | 1% of transaction amount (min ₹249 per transaction) |

Reward Rate & Reward Redemption

The IndiGo IDFC FIRST Credit Card is centered around IndiGo’s BluChips rewards program. It offers higher earning rates on flight bookings and lower returns on other categories. Cardholders can earn up to 22 BluChips for every ₹100 spent when booking flights directly on the IndiGo website or app. This includes 6 BluChips from the credit card and up to 16 BluChips from IndiGo, depending on the customer’s tier in the BluChips program.

For regular retail categories, the reward structure is more modest. You earn 3 BluChips for every ₹100 spent on dining, entertainment, and general purchases. In contrast, UPI payments, rent, utilities, fuel, and wallet reloads earn only 0.5 BluChips for every ₹100. This leads to a much lower reward rate for utility-based or necessary expenses.

You can redeem BluChips only through the IndiGo BluChips platform. The value of each BluChip is not fixed; it changes based on flight prices and availability, which makes the value less clear. You can use BluChips to reduce base fares during IndiGo flight bookings, but they do not cover taxes or convenience fees, which must be paid separately.

My Thoughts – IndiGo IDFC FIRST Credit Card Review

The IndiGo IDFC FIRST Credit Card introduces a new idea with its dual card setup, featuring one Mastercard and one RuPay card. This allows for international use and UPI payments from a single account. It’s an interesting concept, but most users might find the overall value lacking. as per my opinion the ₹4,999 joining fee seems high and forum threads like reddit users also beleving in the same, especially since the card is only usable with IndiGo services. It offers no airport lounge access, and there’s no clear BluChips conversion rate, which makes the reward value uncertain. Even the FD-backed version lacks any welcome perks, which makes it less appealing.

On the plus side, there are some advantages: the 1.49% forex markup is competitive, and milestone spending rewards (up to 25,000 BluChips annually) can be beneficial for frequent IndiGo travelers. However, for the average user or those looking for more travel or lifestyle benefits, the returns may not be worth the price. In summary, this card may be a good fit for dedicated IndiGo fans, but others may find better value elsewhere.

Frequently Asked Questions

- What is the joining fee for the IndiGo IDFC FIRST Credit Card?

The joining fee is ₹4,999 plus GST. This fee is waived if you choose the fixed deposit option by pledging ₹1 lakh, but that option does not include welcome benefits. - Can I use BluChips for IndiGo flight bookings?

Yes, you can use BluChips to book any IndiGo-operated flight in economy or Stretch class, depending on seat availability. You can redeem them on the IndiGo website or app. - Are there blackout dates for redeeming IndiGo BluChips?

No, there are no blackout dates. You can redeem BluChips at any time, even for the last available seat on eligible flights. - Can I use IndiGo BluChips to pay for taxes or add-ons?

No, you cannot use BluChips to pay for government taxes, convenience fees, or 6E add-ons. You must pay these charges separately in INR. - Is airport lounge access included with the IndiGo IDFC Credit Card?

No, this card does not provide any domestic or international lounge access, even though it is advertised as a travel-focused product.