The IDFC FIRST Millennia Credit Card Review explains why this card is one of the most popular lifetime-free options for young professionals. It has no joining or annual fees and offers everyday value with a straightforward rewards program and lifestyle perks. Cardholders earn 3X reward points on regular spending and 10X rewards on purchases over ₹20,000 per month or on birthdays. The points do not expire. The card also offers welcome benefits worth up to ₹1,500 and low finance charges starting at 0.75% per month, equivalent to approximately 9%. This makes it an affordable and rewarding choice.

IDFC FIRST Millennia Credit Card Benefits

The IDFC FIRST Millennia Credit Card offers numerous benefits, making it a great option for daily use. One of its main features is that it has no joining or annual fees. This is appealing for millennials and first-time card users who want high value at no cost.

In terms of rewards, the card gives 3X reward points on everyday purchases. Users can earn 10X points on monthly spending over ₹20,000 and on birthdays. Since the points do not expire, users can accumulate them over time and redeem them at their convenience.

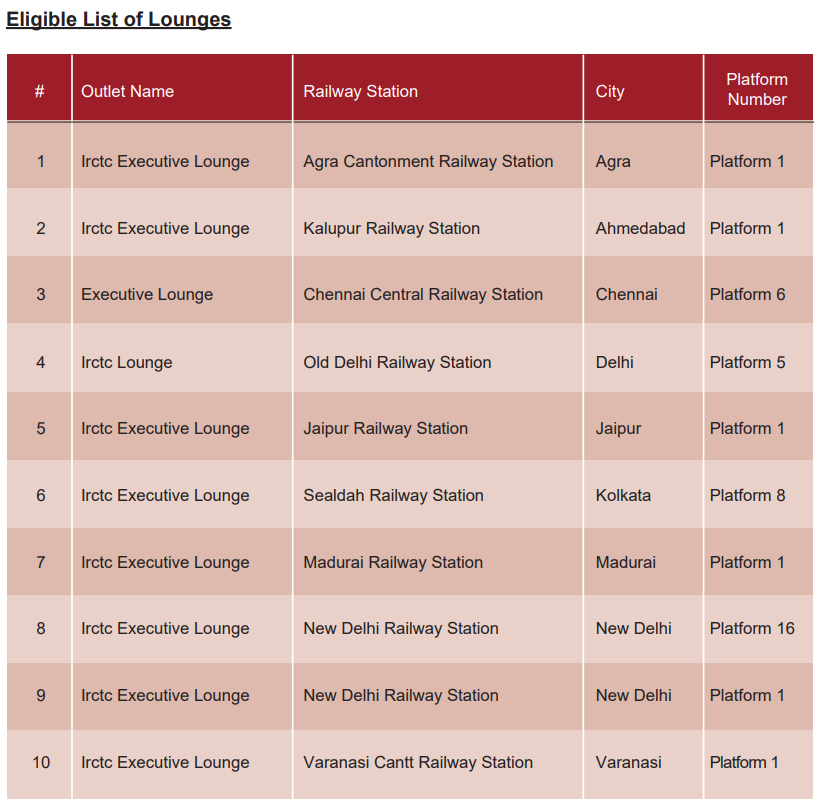

The card also includes welcome benefits worth up to ₹1,500. This package features a shopping voucher and cashback on the first EMI transaction. For travel, users get complimentary railway lounge access four times a quarter and roadside assistance valued at ₹1,399. For entertainment and lifestyle, cardholders can enjoy 25% off on Paytm movie tickets once a month and discounts at many restaurants and health outlets.

These benefits come with low finance charges starting at 0.75% per month, equivalent to approximately 9% APR. This makes it affordable for those who sometimes carry balances. With rewards, travel perks, lifestyle discounts, and no annual fees, the IDFC FIRST Millennia Credit Card offers a solid option for everyday spending.

IDFC FIRST Millennia Credit Card Railway Lounge Access

The IDFC FIRST Millennia Credit Card does not include airport lounge access. Instead, it allows cardholders complimentary visits to railway lounges, with up to four visits per quarter at select railway stations throughout India. This feature makes the card a better choice for domestic travelers who often use trains instead of airports. For those seeking airport lounge benefits, IDFC’s premium cards like the IDFC FIRST Wealth Credit Card or Select Credit Card might be better options.

IDFC FIRST Millennia Credit Card Welcome Benefits

The IDFC FIRST Millennia Credit Card offers new users simple and valuable welcome perks. By spending ₹5,000 within the first 30 days of card activation, cardholders earn a ₹500 gift voucher from popular brands like Amazon, BigBasket, Uber, or Lifestyle. Additionally, the card provides 5% cashback (up to ₹1,000) on the first EMI transaction made within the same 30-day period.

In total, these welcome benefits can amount to ₹1,500 in value. This is significant because the card is free for life with no joining or annual fees. For millennials new to credit cards, this upfront reward makes the Millennia card an affordable option. It also encourages users to explore EMI and digital redemption features right away.

IDFC FIRST Millennia Credit Card Reward Points

The IDFC FIRST Millennia Credit Card has a tiered structure. You earn 3X reward points on total spending up to ₹20,000 in a statement cycle. For any amount above ₹20,000 and on birthday spending, you earn 10X reward points. Certain categories, such as education, wallet loads, government payments, rent, and property management or purchase, earn 3X but do not count toward the 10X milestone. Utilities and insurance earn 1X, while EMI-converted spending, cash withdrawals, fuel, and fees do not earn points. Only transactions that settle before the statement date qualify for that cycle’s 10X calculation.

For valuation and redemption, you earn 1 reward point for every ₹150 spent, and 1 point equals ₹0.25 when redeemed. Points do not expire, are credited at statement generation, and there is a ₹99 plus GST redemption fee when you redeem. You can redeem points instantly at partner stores and online through the bank’s platform.

Fees And Charges

| Fee Type | Charge / Range |

|---|---|

| Joining / Annual / Add-on Fees | None — completely free |

| Finance Charges (APR) | 0.75% – 3.5% per month (≈9%–42% p.a.) |

| Overdue Interest | 3.99% per month (≈47.9% p.a.) |

| Cash Advance Fee | ₹199 + GST per withdrawal; interest-free up to 45 days |

| Late Payment Fee | 15% of due amount (min ₹100, max ₹1,250) |

| Fuel Surcharge Waiver | 1% waiver with maximum ₹200 per cycle |

| Reward Redemption Fee | ₹99 + GST per redemption |

IDFC FIRST Millennia Credit Card Review

The IDFC FIRST Millennia Credit Card is designed as an entry-level product, and its main strength is that it has no lifetime fees. For newcomers, not having to pay annual or renewal fees is a significant benefit, especially since most cards in this category charge at least a small fee after the first year.

The reward system is well-designed. Cardholders can earn 3X reward points on regular spending and 10X points on higher monthly spending or birthdays. This setup helps users get the most value out of their planned usage. The reward points do not expire, allowing users to gather and use them at their own pace. The conversion rate is decent, making the program straightforward and rewarding.

The welcome benefits also enhance the card’s attractiveness. Users receive a gift voucher and cashback on their first EMI transaction, with a total value of up to ₹1,500. This type of offer is rare among lifetime-free cards, which usually lack welcome perks.

Regarding travel perks, not having airport lounge access is acceptable for a beginner-friendly card. Instead, it offers access to domestic railway lounges, catering to many Indian commuters. While premium travelers might view this as a limitation, it is a reasonable trade-off for a card that doesn’t incur annual fees.

Overall, this review indicates that the IDFC FIRST Millennia Credit Card is a well-rounded entry-level option. It suits users seeking a no-fee card with a practical rewards system, decent lifestyle perks, and unique welcome benefits, without the expectation of high-end travel privileges.

Frequently Asked Questions

- What are the benefits of the IDFC FIRST Millennia Credit Card?

The IDFC FIRST Millennia Credit Card offers a lifetime free membership, 3X to 10X reward points, welcome benefits worth up to ₹1,500, complimentary railway lounge access, roadside assistance, dining discounts, and a 25% discount on Paytm movie tickets once a month. These features make it a valuable entry-level card. - Does the IDFC FIRST Millennia Credit Card have airport lounge access?

No, the IDFC FIRST Millennia Credit Card does not provide airport lounge access. Instead, it allows four complimentary railway lounge visits each quarter, making it more suited for domestic train travelers. - What are the charges on the IDFC FIRST Millennia Credit Card?

The card is free for life, with no joining or annual fees. Finance charges range from 0.75% to 3.5% per month. Late payment fees are 15% of the due amount, capped at ₹1,250, and the fuel surcharge is waived up to ₹200 per cycle. A redemption fee of ₹99 plus GST applies when using reward points. - What is the eligibility for the IDFC FIRST Millennia Credit Card?

Applicants must be Indian residents, typically between 21 and 65 years old, with a stable income. Approval is based on the bank’s internal credit policies, proof of income, and credit score. - How can I apply for the IDFC FIRST Millennia Credit Card?

You can apply online through the IDFC FIRST Bank website or mobile app, or through select partner platforms. The process is digital and requires basic KYC documents like Aadhaar, PAN, and proof of income. - What are the international transaction charges on this card?

The IDFC FIRST Millennia Credit Card charges a 3.5% forex markup fee on international transactions. This is typical for most entry-level credit cards. - What movie offers are available on the IDFC FIRST Millennia Credit Card?

Cardholders receive a 25% discount, up to ₹100, once a month on Paytm movie tickets, providing a small lifestyle benefit at no additional cost. same is declared in official document of IDFC. - How do reward points work on the IDFC FIRST Millennia Credit Card?

You earn 3X reward points on spending up to ₹20,000 per month and 10X on any amount beyond ₹20,000 or on birthdays. Each reward point is worth ₹0.25, and points never expire, though a redemption fee of ₹99 plus GST applies. - How does the IDFC FIRST Millennia Credit Card compare with the IDFC FIRST Classic Credit Card?

Both cards are lifetime free, but the Millennia Credit Card offers higher reward rates, railway lounge access, and better welcome benefits, making it more appealing for young professionals. The Classic variant is simpler and has fewer lifestyle perks. - How does the IDFC FIRST Millennia Credit Card compare with the IDFC FIRST Select Credit Card?

The Select Credit Card is a higher tier option, offering airport lounge access and better milestone benefits, but it may have stricter eligibility criteria. The Millennia Card aims to be a no-fee, beginner-friendly choice with straightforward rewards and railway lounge benefits.